Retail Real Estate Finance - Property Takaful (all risks)

- Home

- Personal Banking

- Accounts

ACCOUNTS

A full range of products and services that cater to all your needs.

Fixed Deposit

Secure and guaranteed Sharia'a-compliant profit distribution.

Flexible investment periods from 1, 3, 6, 9 & 12 months

SMS notifications of account activities

Free e-statements

Online & Mobile Banking services

Flexi Long Term Deposit Account

Highest EARNINGS the way you want!

4.40%* Highest Expected Returns

Multi-currency USD or AED Deposit with up to 70% Finance credit limit against the deposit amount

Profit Payment Frequency: Monthly, Quarterly, Semi Annually, or Annually

SIB MaxPlus Account

Maximum profit, maximum flexibility

Finance against your deposit up to 90%

Maximize your profit up to 12%

Access to fund anytime without breaking the deposit

Current

Reliable banking for all your day-to-day needs.

Unlimited deposits and withdrawals at 100+ ATMs across UAE

Free debit card, complimentary cheque book, choice of currency

SMS notifications, free e-statement service

Online Banking and Mobile Banking

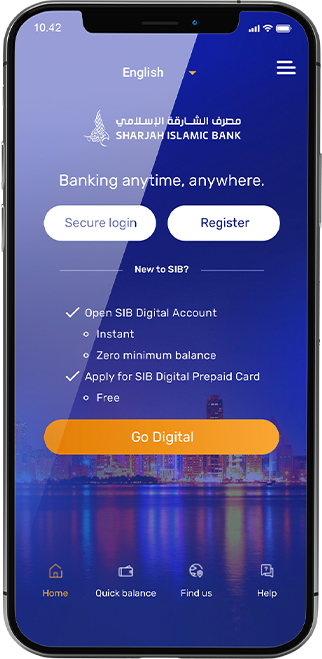

Digital

The future of banking is here.

Available for customers through Mobile Banking - SIB Digital App

Monthly profits

No minimum balance requirement, fees or charges

Savings

Earn while saving and secure your future.

Unlimited deposits and withdrawals at 100+ ATMs across UAE

Free debit card and choice of currency

SMS notifications and free e-statements

Online & Mobile Banking services

Hassalati

Responsible saving from an early age.

Free standing order from parents’ account

Monthly profits on savings

SMS notifications of account activity

Bank statement generated every 6 months

Watani

Earn every day.

Higher withdrawal limits and dedicated relationship managers

Unlimited deposits and withdrawals at 100+ ATMs across UAE

Fast-track decisions on all finances

Exclusive foreign exchange rates and other services

Need help choosing?

We are here to help you make the right decision according to your daily needs.

Customize your banking experience based on your financial goals.

Explore all the ways that you can make smart investments and make your money work even harder for you.

Set up a student account

We support the education of the future generations with innovative, specialized banking products.

I am a salaried individual

Find out the full range of options offered based on your income profile.

Partial Payment of Cheque

Reference to the latest Central Bank requirement, we would like to inform you that, effective 2nd January, 2022, if a cheque was presented for payment and then returned due to insufficient funds, the bearer of the cheque can directly approach the issuing

bank and request to partially pay the value of the cheque up to the available funds.

Beneficiary/ Bearer can request multiple numbers of partial payments until the full value of the cheque is paid or cheque becomes stale (within 180 days from date of the cheque) provided the original Cheque is presented at all times and partial payment

amount is more than 5% of the original Cheque amount.

Discover the future of banking with our Digital Account

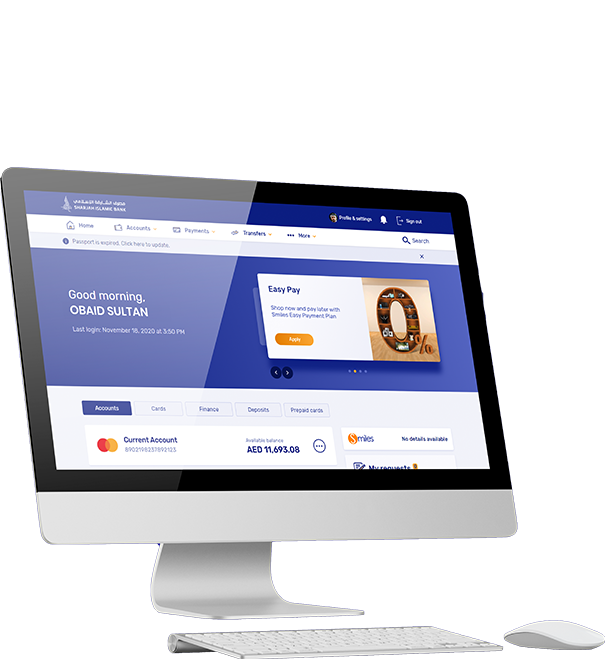

Enjoy flexibility and convenience with Online Banking.

Bank on the go – whenever and wherever you are.

How can we help you?

Get in touch

Write to us and we will get back to you soon.

Rate Us

Participate and share your SIB experience with us.

Apply Online

Start Banking with SIB today.

Notice

Your web browser is not fully supported by SIB and m.sib.ae. For optimal experience and full features, please upgrade to a modern browser.

You can get the new Chrome at Download Chrome.

For an optimal experience, please

For an optimal experience, please